BLOG

POPULAR ARTICLES

Pashupati Group’s Role in Advancing Extended Producer Responsibility (EPR) for Plastic Waste Management

27 May, 2025

The plastic refuse crisis intensifies across India daily. Responding decisively, Pollution Control regulatory authorities established regulations on Extended Producer Responsibility in plastic requiring manufacturers to manage environmental impacts throughout product lifecycles. While brands bear legal compliance burdens, recycling firms like Pashupati Group serve as vital implementation partners. Their sophisticated processing infrastructure and data-verified tracking systems help fulfil EPR compliances for plastic waste recycling obligations while advancing circular plastic economy goals nationwide.

What is Extended Producer Responsibility (EPR)?

From the thought table of Thomas Lindhqvist of Sweden in 1990 till today, Extended Producer Responsibility emerged as a disposal governance framework that shifts ecological burden to manufacturers post-consumer use. This mechanism requires producers to manage materials through collection, reprocessing or elimination. It aims to reduce disposal site burden while promoting sustainable packaging alternatives.

Indian legislation codified these principles through 2016 statutes with later revisions, and introduced digital platforms as Centralised EPR Portal to track the waste generations, recoveries and the responsible entities from year 2022. These responsible entities face annual recovery quotas and must incorporate reconstituted materials in new packaging, reinforcing material cycling.

This approach aligns with regenerative economic models that maximise material value retention and minimise waste through intentional design.

Key EPR Regulations and Compliance Guidelines for Companies operating in India:

For companies using or manufacturing plastic packaging, EPR compliance involves a series of legally binding obligations:

1. Mandatory Registration

All Plastic Packaging Producers, Importers, Brand owners (PIBO), Manufacturer of Virgin Plastic, Seller of Raw Material/Intermediate material for packaging and Plastic waste Processors (Recycler, Co-Processor) must get registered on the Central Pollution Control Board’s (CPCB) online EPR portal.

2. Plastic Waste Targets

PIBOs must collect and manage a volume of plastic waste equivalent to what they introduce into the market. This includes collection, processing, and recycling, or they can simply tie-up with the PWPs to do the above obligation on their behalf.

3. Mandatory Use of Recycled Plastic

Commencing FY 2025-26 PIBOs are required mandated to use a certain percentage of recycled plastic in their plastic packaging, which has been divided as per packaging type(Rigid, Flexible, Multi-Layer Plastic):

- • Category I (Rigid plastic packaging): Minimum 30% recycled content.

- • Category II (Flexible plastic packaging): Minimum 10%.

- • Category III (Multi-layered packaging): Minimum 5%.

These percentages will increase in the subsequent financial years.

4. Annual Documentation

Registered entities must submit comprehensive yearly reports via the CPCB’s EPR portal, providing details such as Purchase & Sales related to Plastic Packaging and status of EPR target fulfilment.

5. Regulatory Consequences

Target shortfalls may trigger Environmental Compensation or operational authorisation revocation. Environmental authorities possess oversight, verification and enforcement capabilities against non-compliant participants.

This methodical reporting and regulatory structure establish material tracking, participant responsibility and incentivises sustainable material transitions.

EPR Implementation Challenges: Barriers and Solutions

Despite robust theoretical frameworks, real-world implementation encounters substantial obstacles:

1. Infrastructure Gaps

Many regions still lack sufficient waste collection, segregation and recycling infrastructure. Urban areas fare better, but rural waste management systems remain underdeveloped.

2. Data Collection and Traceability

One of the biggest bottlenecks in EPR compliance is data accuracy. PIBOs and PWPs are required to submit detailed documentation—including the source of plastic waste, processing quantities, invoices, and buyer details. Ensuring this level of transparency is nearly impossible without a robust digital system. While many processes are being digitized by the CPCB through the EPR Portal, challenges remain for entities that are registered or wish to register. These challenges are largely due to the slow turnaround time of the CPCB and SPCBs in implementing necessary updates and changes

3. Lack of Awareness

Many companies are either unaware of the finer aspects of EPR or are wilfully overlooking their responsibilities, including the registration and data reporting on the CPCB’s EPR portal. As a result, participation remains low, and the intended impact of the regulation is significantly diminished.

4. Limited Access to Recycled Material

PIBOs often cite lack of quality recycled plastic as a reason for low usage. This is largely due to informal recycling chains and lack of certification.

Solutions:

The Crucial Role of Recycling Companies in EPR Compliance

While brands hold the legal responsibility for EPR compliance, it’s the recyclers who do the heavy lifting—turning obligations into action and making the entire system function on the ground

1. Plastic Waste Procurement

Recyclers like Pashupati procure plastic packaging waste from informal & formal collectors, municipal bodies, and institutional partners.

2. Recycling and Material Recovery

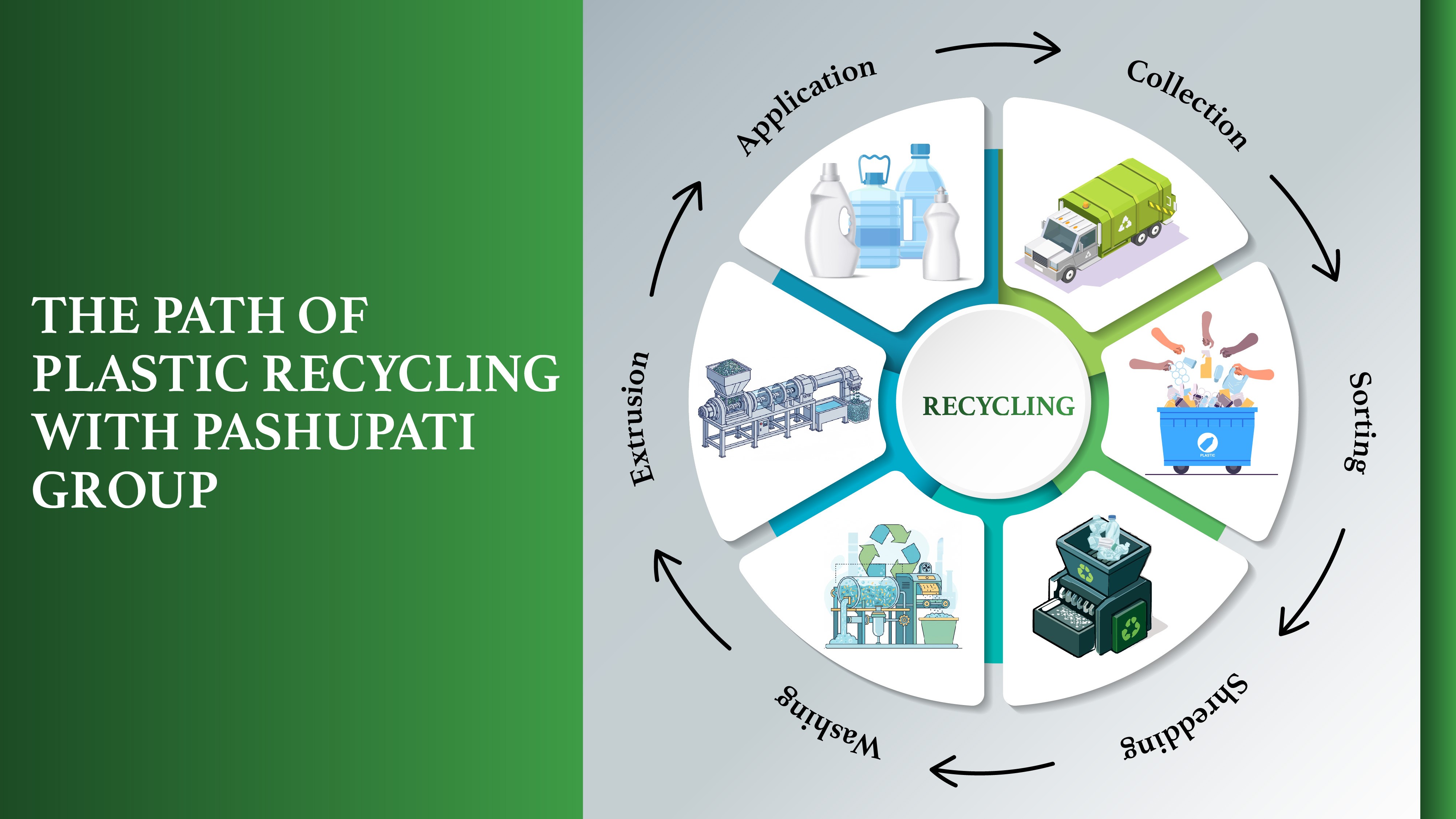

The collected waste is sorted, washed, and converted into raw materials such as flakes, granules and fibers. These are then used to manufacture various type of plastic products such as plastic packaging, textile fibers and many more. Additionally, Pashupati Group operates on certified processing technology for PET bottle through which their finished products can directly be used in making food-contact packaging.

3. EPR Credit Generation

Only after the recycled material is sold to an end-user, the recycler earn EPR credit. These credits are then sold - at a transparent and competitive cost - to PIBOs who need them to offset their EPR obligations. The entire transaction, from waste collection to credit generation, is logged on the CPCB’s digital portal.

4. Documentation and Reporting

Pashupati Group maintain comprehensive documentation - source data, processing records and GST invoices which are shared with the PIBOs while fulfilling their EPR target and as per the Annual Return compliance process.

This transparent system ensures that credits represent actual recycling activity and not just paper compliance.

Pashupati Group’s EPR Process: A Model of Transparency and Scale

Pashupati Group operates one of India’s most integrated plastic recycling setups, making them a trusted name in EPR facilitation.

1. 4 EPR Registered Units

Out of its 8 manufacturing facilities, four are formally registered with CPCB as a PWP for EPR plastic waste management facilitation. These units are equipped to handle both Category I and Category II type of plastic containing different polymers like PET, HDPE, LDPE, PP, LLDPE and process them into recycled flakes, granules and staple fiber.

2. Four Active Recycling Units for EPR Target Fulfilment

These four active recycling facilities are dedicated to processing post-consumer plastic waste and generating EPR credits. These units operate through fully digitised systems, capturing all essential data to ensure traceability, transparency, and audit readiness.

In addition to supporting EPR credit generation, Pashupati is also enabling PIBOs to meet their recycled content targets—effective from 1st April 2025—by supplying high-quality recyclates produced at these facilities.

3. How It Works

For example, suppose 1,000 kg of plastic bottles are processed, and 950 kg of recyclable output is produced, unless that 950 kg is sold to a legitimate buyer and recorded on the EPR portal, no credits are issued. The credits issued are dependent upon the traceability data and production quantity infeed. This ensures that EPR credits are grounded in real recycling of plastic packaging waste only.

4. Waste Traceability

Every kilogram of plastic waste entering Pashupati’s system is accounted. The group uses in-house digital tools, integrated with the CPCB’s portal, to record procurement data, production data and sales data at invoice level.

This meticulous record-keeping builds credibility and offers brands peace of mind that their credits are legitimate.

Future Outlook and Emerging Opportunities

India’s EPR regime is still evolving, and several growth avenues are emerging:

1. Growth in Recycled Plastic Market

As the use of recycled content becomes mandatory, demand for high-quality recycled plastic will surge. Pashupati, with its scalable infrastructure, is well-positioned to capture this demand.

2. Chemical Recycling

Mechanical recycling has its limits, especially for multi-layered plastics. Chemical recycling, though still emerging, could allow infinite recyclability without quality loss, an area ripe for investment. Pashupati Group is already doing the chemical recycling at one of its unit for PET since many years paving the way for other polymers.

3. Digital Innovations

Blockchain-enabled traceability, AI-driven sorting technologies, and mobile reporting apps will likely become industry standards, enhancing data credibility and compliance.

4. International Collaboration

As EPR gains traction globally, cross-border credit trading and harmonisation of standards may emerge, offering Indian recyclers access to international credit markets. Conclusion

Extended Producer Responsibility is no longer a future concept. It is current law, backed by data mandates, digital enforcement, and environmental urgency. While brands carry the legal responsibility, companies like Pashupati Group are doing the heavy lifting - collecting, processing, documenting, and closing the loop on plastic waste.

By converting discarded plastic waste into valuable resources and maintaining complete transparency, Pashupati empowers brands to meet their EPR plastic targets efficiently. As India marches toward a circular plastic economy, collaborations between PIBOs and Recyclers will define the country’s environmental legacy, and Pashupati is leading from the front.

-

- • Digitalisation: Advanced traceability software and mobile applications are being adopted to log waste journeys in real-time.

- • Partnerships with certified recyclers: Collaborating with large-scale recyclers like Pashupati Group streamlines compliances, provides recycled content and ensures EPR Obligation fulfilment.

- • Policy awareness drives: Government and industry bodies must educate smaller companies who could come under the purview of EPR regulation on regulatory expectations and best practices.

-

RECENT BLOGS